The S&P 500, a benchmark index tracking the performance of 500 large-cap U.S. companies, offers investors a wide range of opportunities. For those desiring to hone in on their investments within specific sectors, Sector ETFs present as a powerful tool. These exchange-traded funds follow the performance of particular industries, allowing investors to tailor their portfolios based on their investment goals.

- Explore the appeal of technology, pharmaceuticals, or consumer discretionary ETFs, among others.

- Recognizing the characteristic risks and volatility within each sector is crucial for making informed investment decisions.

Research the history of different Sector ETFs, considering factors such as expense ratios, liquidity, and past returns.

Sector ETF Performance: Identifying Opportunities and Risks

Navigating the dynamic world of exchange-traded funds (ETFs) requires a keen understanding of sector trends and their inherent challenges. Investors seeking to leverage market shifts often turn to sector ETFs, which provide targeted exposure to specific industries. While these funds can offer promising returns, it's vital to carefully assess their potential for both profitability and downsides.

For instance, a sector ETF tracking the technology industry might soar during periods of economic growth, but could falter in times of downturn. Evaluating the underlying factors influencing a sector's performance is key to making informed investment choices.

- Investigating recent industry news can provide valuable insights into potential challenges.

- Observing macroeconomic trends and their impact on specific sectors is also important.

- Diversifying your portfolio across different industries can help mitigate volatility.

Leading S&P 500 Sector ETFs for Your Portfolio

When creating a well-diversified portfolio, considering sector-specific ETFs can offer considerable growth opportunities. The S&P 500 index provides a broad overview of the U.S. market, and investors can further target their investment by allocating funds in ETFs that track specific sectors. Amongst the many S&P 500 sector ETFs available, several consistently showcase strong results.

- In terms of example, the software sector has been a trending leader, with ETFs like IYW presenting impressive growth.

- Medical is another sector value consideration, with ETFs like XLV providing predictability and potential for continued growth.

Nevertheless, it's essential to perform your own research before putting money. Consider your financial objectives and the present market environment when making investment choices.

Unlocking Growth via S&P 500 Sector ETFs: An Investor's Guide

The S&P 500 offers a diverse panorama of sectors, each presenting unique growth prospects. For investors seeking to tap into this potential, Sector ETFs have emerged as a strategic tool. By allocating in these funds, individuals can secure targeted exposure to specific sectors influencing market growth. Understanding the nuances of each sector and its inherent challenges is paramount for success. This guide explores the approaches behind investing in S&P 500 Sector ETFs, empowering investors to conquer the market with confidence.

- Exploiting industry trends and fundamental analysis is crucial for sector ETF selection.

- Allocating assets across multiple sectors can mitigate potential losses.

- Observing market conditions and economic indicators provides valuable insights for informed decision-making.

Remember, successful investing in Sector ETFs requires a integrated approach that combines insight with prudent risk management.

Strategic Investing in S&P 500 Sector ETFs: Maximizing Growth

For savvy investors seeking to elevate their portfolio performance, strategic investing in S&P 500 sector ETFs presents a compelling path. These exchange-traded funds provide focused exposure to individual sectors within the U.S. stock market, enabling investors to adjust their holdings based on their investment goals and risktolerance. By carefully get more info selecting ETFs that correspond with their perspective, investors can exploit the growth within specific sectors, consequently aiming to optimize returns.

- Review your strategic goals and risk tolerance|profile}

- Explore the performance and characteristics of various S&P 500 sector ETFs

- Allocate your investments across multiple sectors to reduce risk

- Observe market trends and modify your portfolio regularly

With a well-constructed strategy, investing in S&P 500 sector ETFs can be a effective tool for achieving financial success.

The Power of Specialization: Exploring S&P 500 Sector ETFs

In the dynamic landscape of equities, investors often strive for diversification and targeted exposure to specific market segments. That's where S&P 500 sector ETFs emerge as powerful tools. These funds offer a efficient means to invest in companies within distinct industries, allowing investors to exploit the growth potential of specific sectors. By specializing in these defined areas, investors can potentially maximize their portfolio returns while managing overall risk.

Furthermore, S&P 500 sector ETFs provide transparency into holdings and sector performance, enabling investors to make strategic decisions aligned with their financial goals.

- Explore technology ETFs for exposure to innovative advancements.

- Investigate healthcare ETFs to participate in the growth of the senior care sector.

- Embrace consumer discretionary ETFs to engage with popular sectors.

Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Dawn Wells Then & Now!

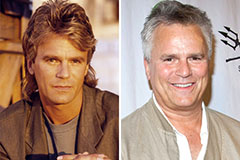

Dawn Wells Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!